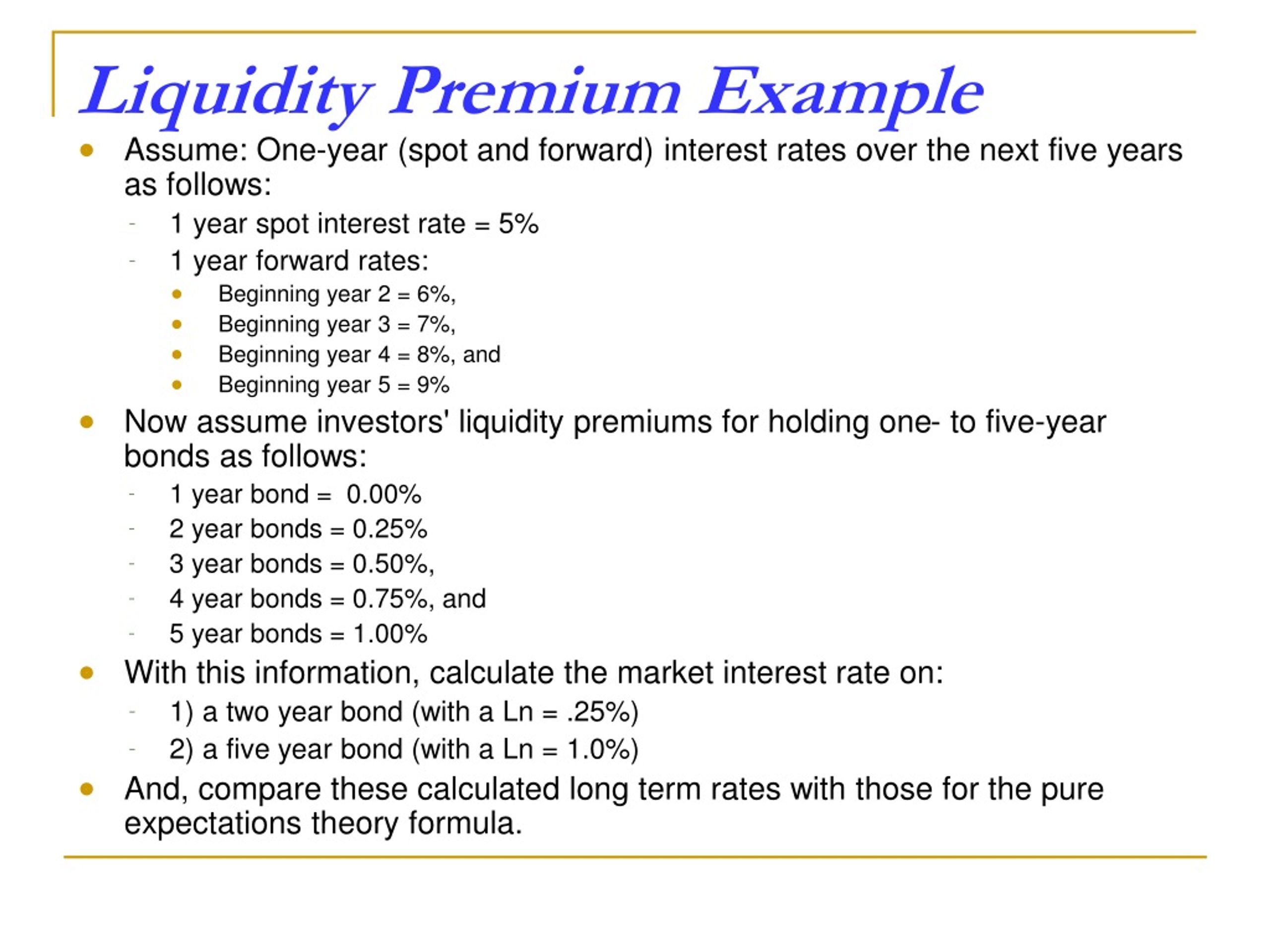

The Liquidity Premium: How To Calculate The Return Investors Require For Illiquid Securities – modeladvisor.com

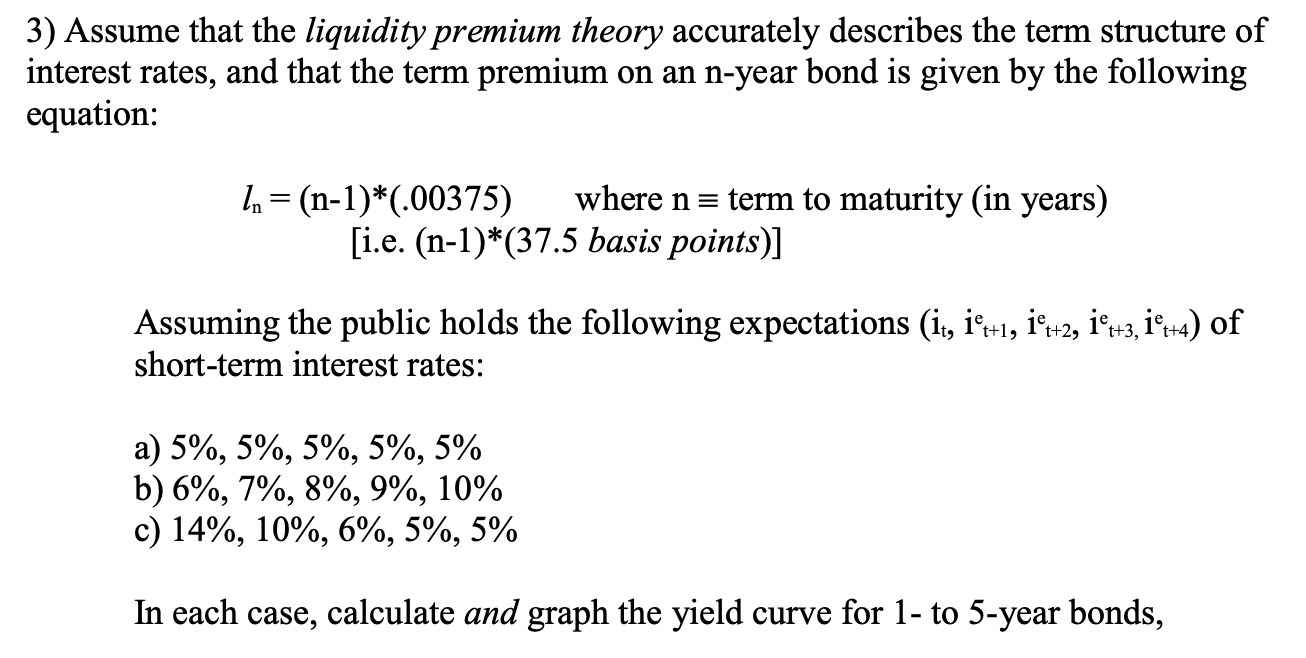

SOLVED: 1.(15) Over the next three years, the expected path of 1-year interest rates is 4, 1 and 1 percent. The liquidity premiums for the one year rate are 0%, 1.0% and

Liquidity premium for different combinations of drift and investment... | Download Scientific Diagram

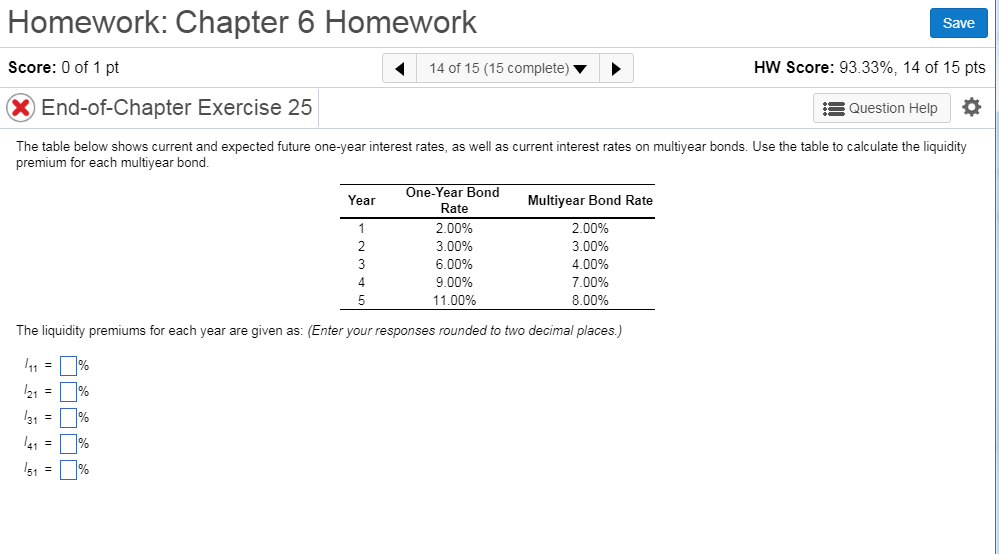

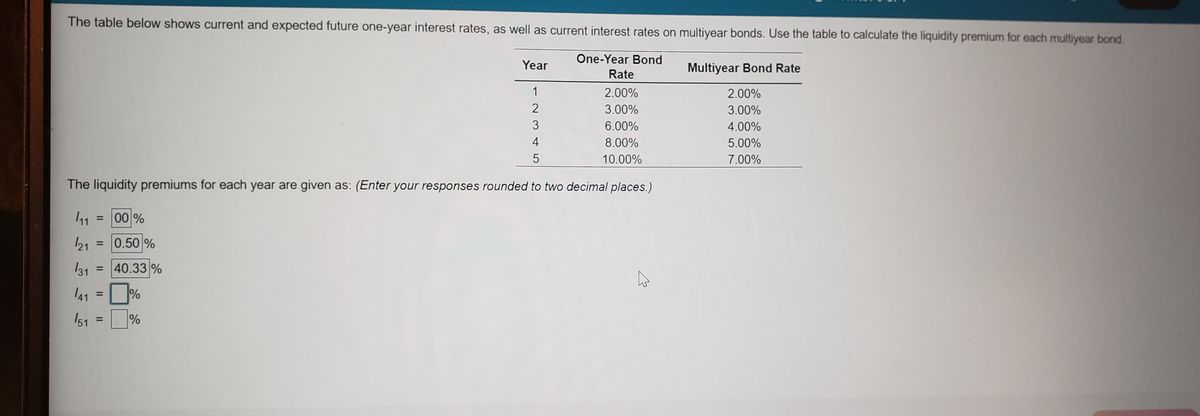

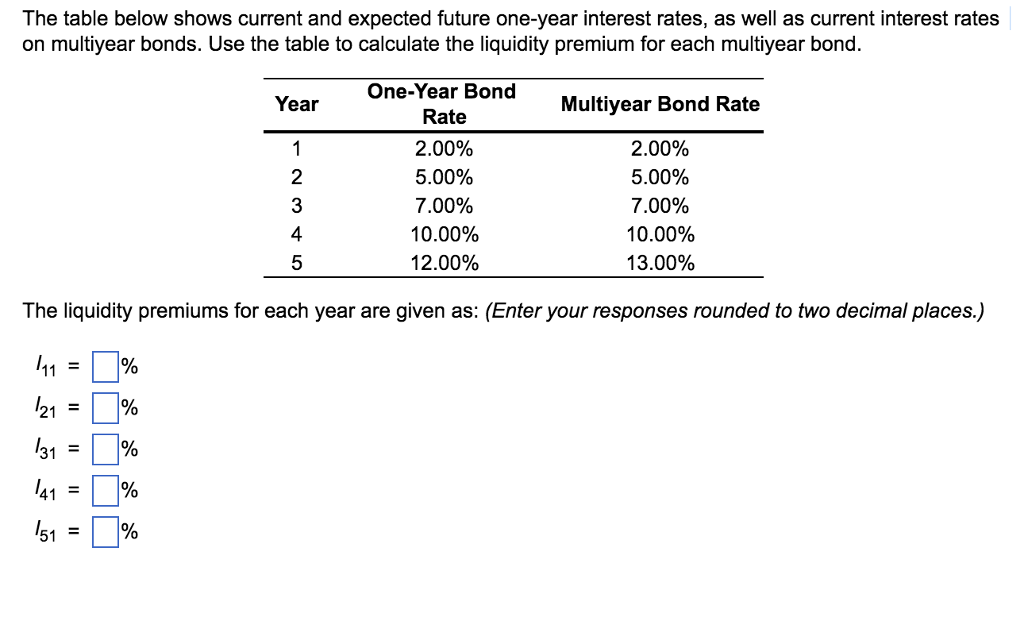

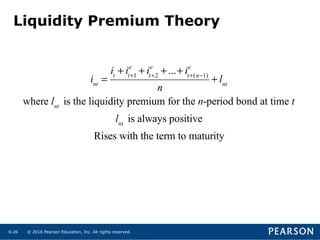

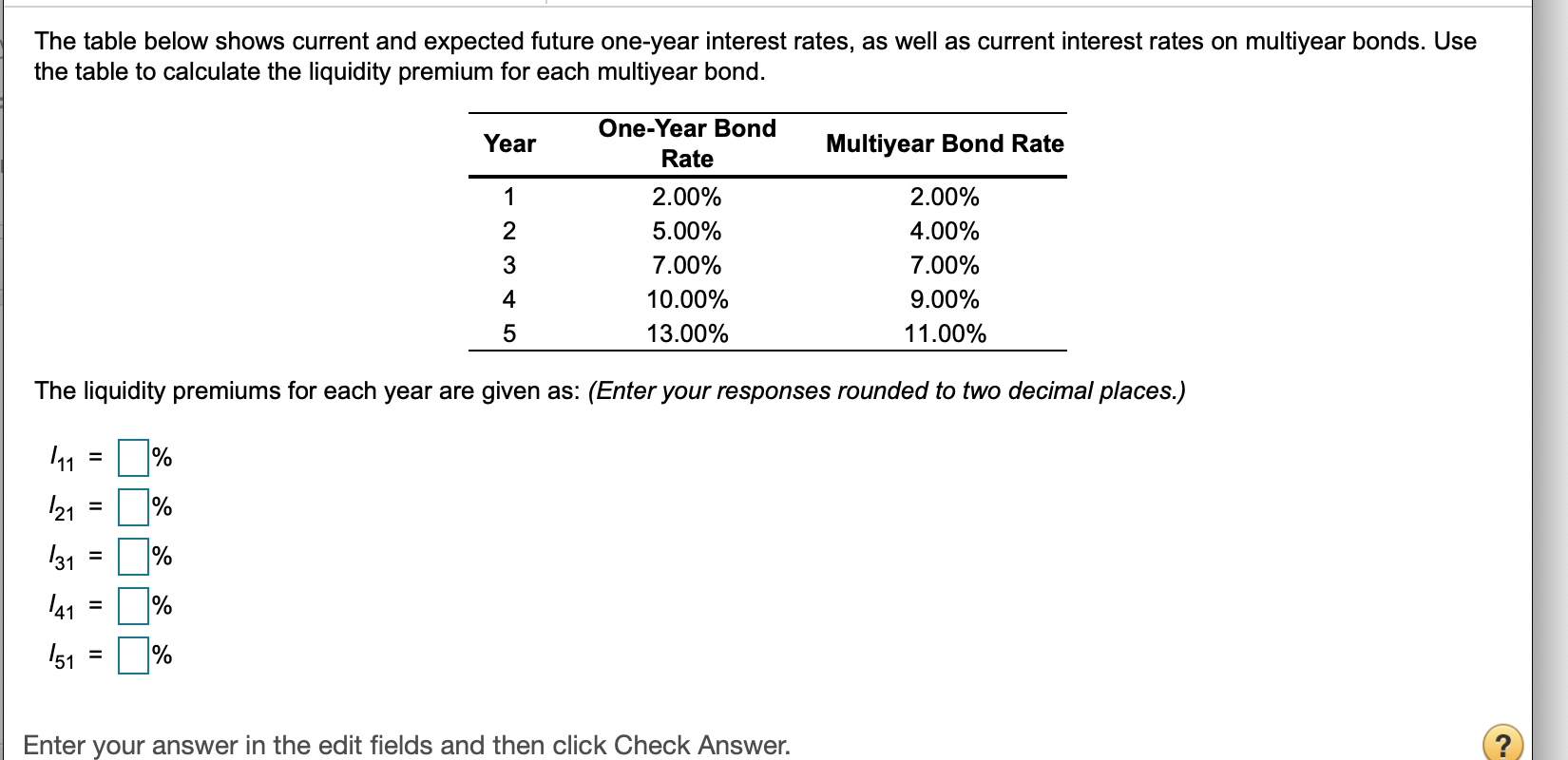

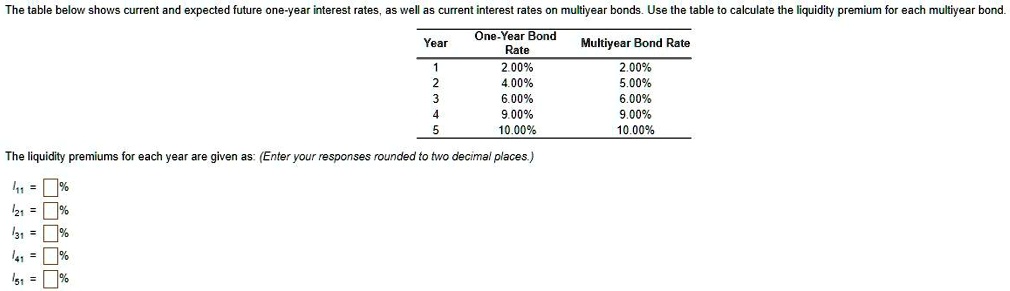

SOLVED: The table below shows current and expected future one-year interest rates,as well as current interest rates on multiyear bonds.Use the table to calculate the liquidity premium for each multiyear bond. Year

SOLVED: The table below shows current and expected future one-year interest rates, as well as current interest rates on multiyear bonds. Use the table to calculate the liquidity premium for each multiyear