IES Flash Alert 2014-114 United Kingdom – Tax Simplification and Some Give and Take in Autumn Statement (December 4, 2014)

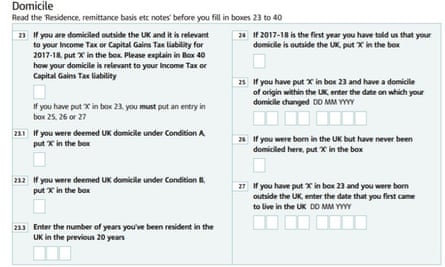

English Tax form sa108 Residence remittance basis etc from HM revenue and customs lies on table with office items. HMRC paperwork and tax paying proce Stock Photo - Alamy

English Tax form sa108 Residence remittance basis etc from HM revenue and customs lies on table with office items. HMRC paperwork and tax paying process in United Kingdom 12978226 Stock Photo at

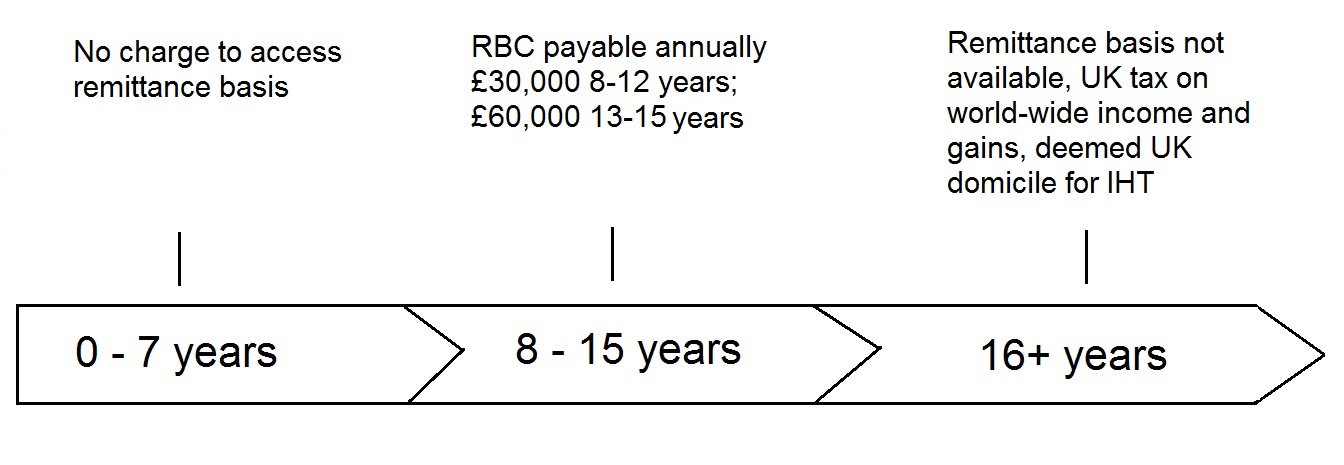

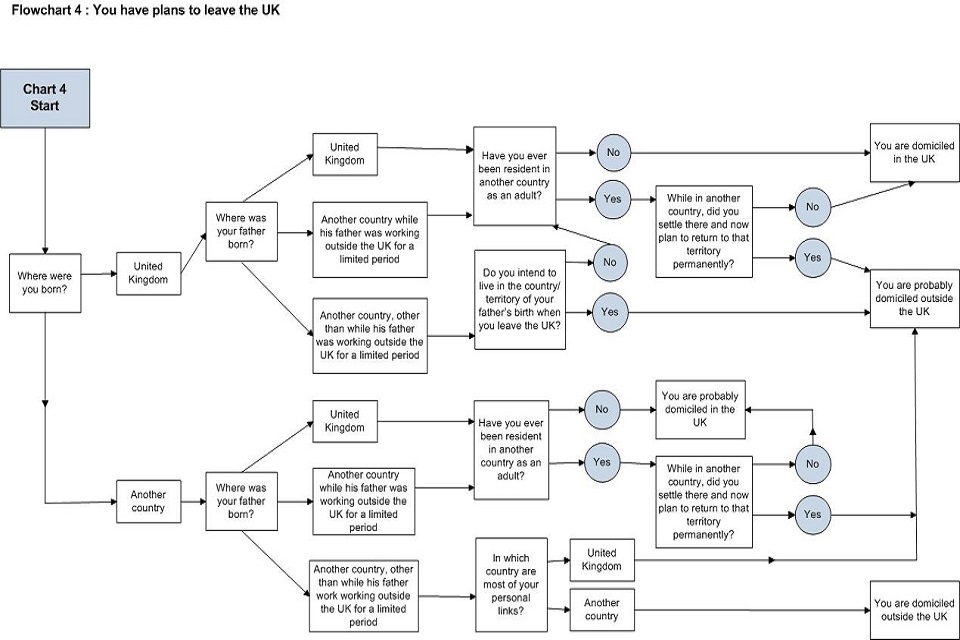

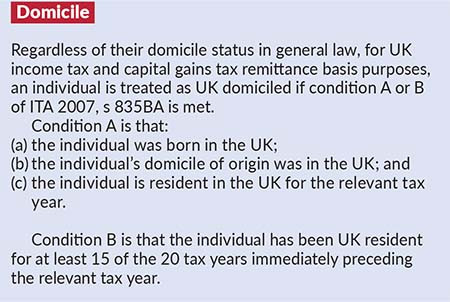

International aspects of personal taxation | P6 Advanced Taxation | ACCA Qualification | Students | ACCA Global